The Primary Difference Between Accrual-basis and Cash-basis Accounting Is

The accrual basis and cash basis accounting are two different accounting methods. Cash-basis accounting is allowed for financial reporting purposes but not accrual-basis accounting.

What Is The Correct Answer When Converting An Income Statement From A Cash Basis To An Homeworklib

The core difference between these two methods of accounting pertains to when revenue and expenses are recognized.

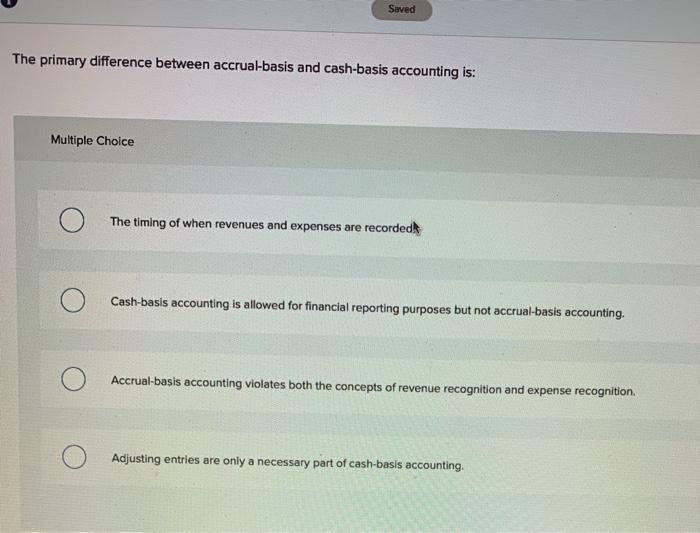

. Cash-basis accounting is allowed for financial reporting purposes but not accrual-basis accounting C. There are two methods law firms can run their accounting by. The timing of when revenues and expenses are recorded 2.

Cash-basis accounting is allowed for financial reporting purposes but not accrual-basis accounting 3. The primary difference between the accrual basis and the cash basis of accounting is. The biggest difference between the two is timing.

The core underlying difference between the two methods is in the timing of transaction recordation. Accrual-basis accounting violates both the revenue recognition and matching principles. In accrual basis accounting revenue is realized when the sale is made even if the payment isnt complete.

In cash basis accounting revenue is recognized once the payment is received. The primary difference between accrual-basis and cash-basis accounting is. The cash bases records revenues when cash is received and records expenses when cash is paid Explanation.

Record revenue when cash is received 4. Cash-basis accounting is allowed for financial reporting purposes but not accrual-basis accounting. The main difference between the two methods is in the timing of transaction recordation.

Record Revenues when earned 2. Revenues are evaluated when the firm is to pay off all its liabilities The cash basis of accounting specifies that the transactions are recorded based on the cash. Accrual basis is complex in nature.

Accrual Basis and Cash Basis Cash Basis Accounting. The primary difference between cash basis and accrual basis accounting is with the timing of transaction recordation. The accrual basis records revenues when services or products are delivered and records expenses when cash is paid.

Cash-Basis tracks income and expenses as the cash flows in and out of the business whereas Accrual-Basis tracks income and expenses as they are incurred regardless of whether or not the cash has been exchanged. Ryzh 129 1 year ago. Cash basis is simple in nature.

2The cash bases records revenues when cash is received and records expenses when cash is paid. Adjusting entries are only a necessary part of cash-basis accounting. There are two primary accounting types.

Accrual accounting means revenue and expenses are recognized and recorded when they occur while cash basis accounting means these line items arent documented until cash exchanges hands. You may select more than one answer. The timing of when revenues and expenses are recorded.

Accrual-basis accounting violates both the revenue recognition and matching principles. Record expenses when benefit is received. The timing of when revenues and expenses are recorded B.

The primary difference between accrual-basis and cash-basis accounting is. Under the cash basis entries in the book of accounts are made when cash is received or paid and not when the receipt or payment becomes due. In cash basis revenues are recognized when actually received and expenses are recognize when actually paid.

Start studying Cash Basis Vs. In aggregated over time the results of these two methods are approximately the same. Accrual-basis accounting violates both the revenue recognition and matching principles.

The main difference between accrual and cash accounting is the fact stated in their definitions. Whereas Under the ac View the full answer Transcribed image text. The primary difference between the two is the point at which revenue is realized.

The cash basis and accrual basis of accounting are two different methods used to record accounting transactions. On the other hand with the cash basis of accounting method revenue and expenses are recorded when the transactions are realized. You might be interested in.

The primary difference of cash basis and accrual basis of accounting is the timing of recognition of revenues and expenses. The primary difference between accrual-basis and cash-basis accounting is. For Accrual based accounting 1.

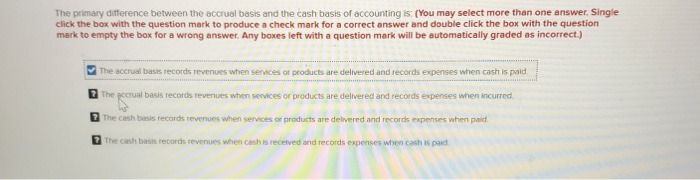

As per cash basis of accounting we record revenues on receipt. The two primary methods available are the cash basis method or the accrual basis method. - The accrual basis of accounting records revenues when services or products are delivered and records expenses when incurred - The cash basis of accounting records revenues when cash is received and records expenses when cash is paid.

The primary difference between the accrual basis and the cash basis of accounting is. Both of these answers are the primary differences. The decision relative to what basis of accounting you should select for tax purposes is an important one.

The accrual basis of accounting specifies that the transactions are recorded based on when they are entered into. 1The accrual basis records revenues when services or products are delivered and records expenses when incurred. The primary difference between the accrual basis and the cash basis of accounting is.

Learn vocabulary terms and more with flashcards games and other study tools. That is the accrual method records expenses and revenue in accounting books regardless of whether cash is paid out or payments are received while cash accounting records transactions after cash are paid out or cash receipt is confirmed. The primary difference between accrual-basis and cash-basis accounting is.

With the cash basis we record revenue when we receive cash from the client and expenses are recorded when we pay cash to employees or suppliers of goods and services Klinefelter McCorkle Klose 2008. The primary difference between the accrual basis and the cash basis of accounting is. Record expenses when cash is paid For cash-basis accounting 3.

It follows a double entry system of accounting where each transaction has two outcomes in the form of debit and credit. The accrual basis in accounting records revenue only when the goods associated have been delivered and records expenses when the company incurs it regardless of when the company actually pays. Cash basis of accounting follows the single entry system that records either inflow or outflow of cash.

The Difference Between the Cash Basis and Accrual Basis of Accounting. The pocrual basis records revenues when services or products are delivered and records expenses when incurred. Accrual basis or cash basis.

Solved The Primary Difference Between The Accrual Basis And Chegg Com

Solved Saved The Primary Difference Between Accrual Basis Chegg Com

Difference Between Cash Basis And Accrual Basis Accounting Accrual Accounting Accounting Accrual

0 Response to "The Primary Difference Between Accrual-basis and Cash-basis Accounting Is"

Post a Comment